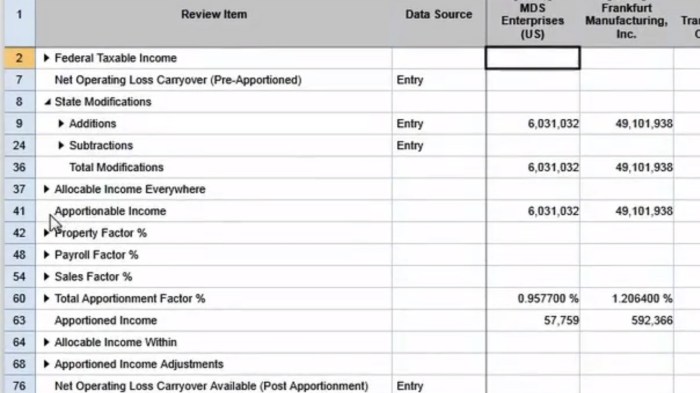

Estimated cash payments do not include all cash expenses. This exclusion can have significant implications for financial planning and budgeting. Understanding what is excluded from estimated cash payments is crucial for accurate financial forecasting and effective cash flow management.

Commonly excluded cash payments include capital expenditures, loan repayments, and certain types of taxes. These exclusions are typically made for accounting or tax purposes, but they can lead to underestimation of cash needs if not properly considered.

Estimated Cash Payments Overview: Estimated Cash Payments Do Not Include

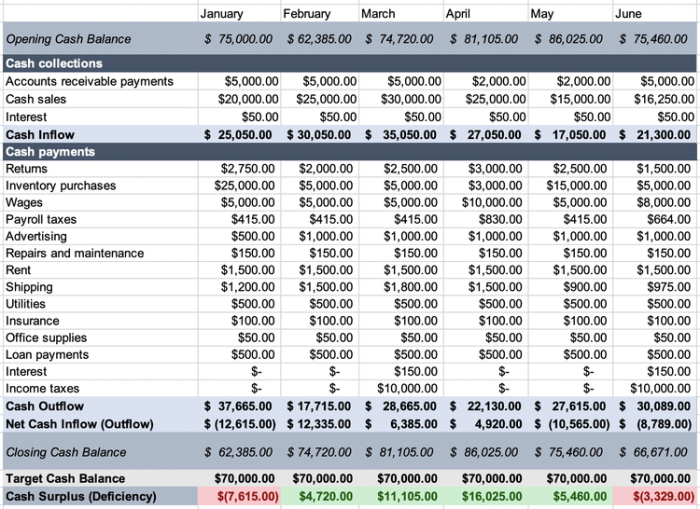

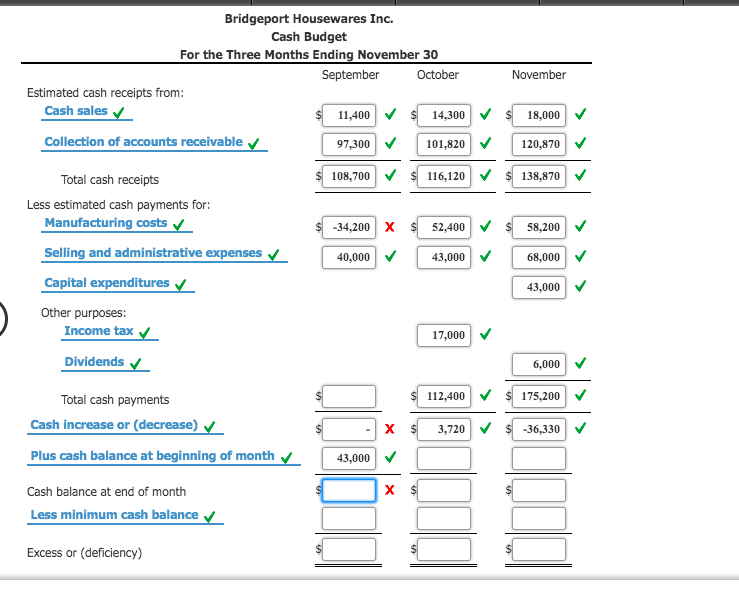

Estimated cash payments are approximations of the cash outflows that a business expects to incur during a specific period. These payments are typically used for planning purposes and can assist in making informed financial decisions.

Estimating cash payments is crucial for businesses as it provides insights into their cash flow patterns and ensures they have sufficient funds to meet their obligations. It helps them avoid potential cash shortfalls, plan for future expenses, and make strategic investments.

Exclusions in Estimated Cash Payments

- Depreciation and Amortization:These are non-cash expenses that do not result in an immediate outflow of cash.

- Stock-Based Compensation:The value of stock options or shares granted to employees is not considered a cash payment.

- Unrealized Gains and Losses:Changes in the value of assets or investments that have not been realized through a sale are not included.

- Owner’s Draws:Withdrawals made by owners from their business are not considered cash payments for the business.

- Extraordinary Expenses:Unusual or infrequent expenses that are not part of normal operations are typically excluded.

These exclusions are made to provide a more accurate representation of the cash flow from operating activities and to avoid double-counting.

Implications of Excluded Cash Payments

Excluding certain cash payments from estimates can lead to an overestimation of cash flow and create a false sense of financial security.

Inaccurate cash flow projections can have negative consequences, such as:

- Difficulty in meeting financial obligations

- Missed investment opportunities

- Impaired decision-making

Therefore, it is crucial to consider all relevant cash payments when making estimates to ensure a realistic representation of a business’s financial position.

Strategies for Accurate Estimation, Estimated cash payments do not include

To ensure accurate estimation of cash payments, businesses should adopt the following best practices:

- Historical Data Analysis:Review historical cash flow statements to identify trends and patterns in cash payments.

- Forecast Revenue and Expenses:Project future revenue and expenses based on current market conditions and business plans.

- Consider Seasonal Factors:Adjust estimates to account for seasonal fluctuations in cash payments.

- Identify Potential Exclusions:Be aware of the common exclusions and consider their impact on cash flow.

- Monitor Actual Cash Flows:Regularly track actual cash flows and compare them to estimates to make necessary adjustments.

By following these strategies, businesses can improve the accuracy of their estimated cash payments and make more informed financial decisions.

Examples of Excluded Cash Payments

| Category | Example | Description |

|---|---|---|

| Depreciation | Building depreciation | Non-cash expense that reduces the value of an asset over time. |

| Stock-Based Compensation | Stock options granted to employees | Non-cash expense that represents the value of shares granted. |

| Unrealized Gains | Increase in value of an investment | Not considered a cash payment until the investment is sold. |

| Owner’s Draws | Withdrawals by owners | Not considered a cash payment for the business. |

Case Study: Impact of Exclusions

ABC Company excluded depreciation and stock-based compensation from its estimated cash payments. As a result, their cash flow projections were overstated, leading to a false sense of financial security.

When actual cash flows fell short of projections, ABC Company faced difficulty in meeting its obligations, missed investment opportunities, and made poor financial decisions. By failing to consider these excluded cash payments, they underestimated their true cash needs and compromised their financial stability.

General Inquiries

What are the most common exclusions from estimated cash payments?

Capital expenditures, loan repayments, and certain types of taxes are commonly excluded from estimated cash payments.

Why are these items excluded?

These items are often excluded for accounting or tax purposes, but they can lead to underestimation of cash needs if not properly considered.

How can I ensure accurate estimation of cash payments?

Carefully consider all potential cash expenses and identify any that may be excluded from estimated cash payments. Use a comprehensive budgeting tool or consult with a financial professional for assistance.